MEYERSON LAW FIRM

Our friendly team is always available to help you. At Meyerson Law Firm, we make the process of planning for the future pleasant. Clients enjoy planning and executing their family's plan with our help.

We handle a variety of legal matters, including:

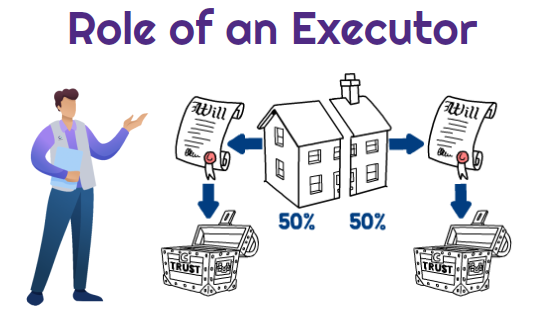

- Estate and Trust Administration

- Long Term Care Planning

- Medicaid Asset Protection Trust

- Guardianship/Conservatorship

- Probate

- Probate and Fiduciary Litigation

Estate Planning

- Revocable and Irrevocable trusts

- Wills

- Financial power of attorney

- Advance healthcare directive

- International Estate Planning

A Team You Can Trust

You can count on Meyerson Law to address your concern with care and attention to detail. We take the time to understand your case before we make recommendations. We are available every to answer all your questions and address any concerns you may have. We are responsive to our clients, and you can expect a person to answer our phones. If you call outside of business hours, we will return your call no later than the next day and usually much sooner.

Contact Meyerson Law Firm

If you need assistance with Estate Planning, Medicaid Asset Protection, or Probate/Probate Fiduciary Litigation, Meyerson Law Firm is here to help! Please contact our office today 678-892-5910 to learn more about our services or to schedule a consultation with our team. We proudly serve clients all throughout the state of Georgia.

Recent Blog Posts

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Please do not act or refrain from acting based on anything you read on this site. Using this site or communicating with Meyerson Law, LLC through this site does not form an attorney/client relationship. You should not send us any confidential information in response to this website. Such responses will not create a lawyer-client relationship, and whatever you disclose to us may not be privileged or confidential unless we have agreed to act as your legal counsel and you have executed a written engagement agreement with Meyerson Law, LLC.

This site is legal advertising. The material on this website may not reflect the most current legal developments. The content and interpretation of the law addressed herein is subject to revision. We disclaim all liability in respect to actions taken or not taken based on any or all the contents of this site to the fullest extent permitted by law.